Table of Content

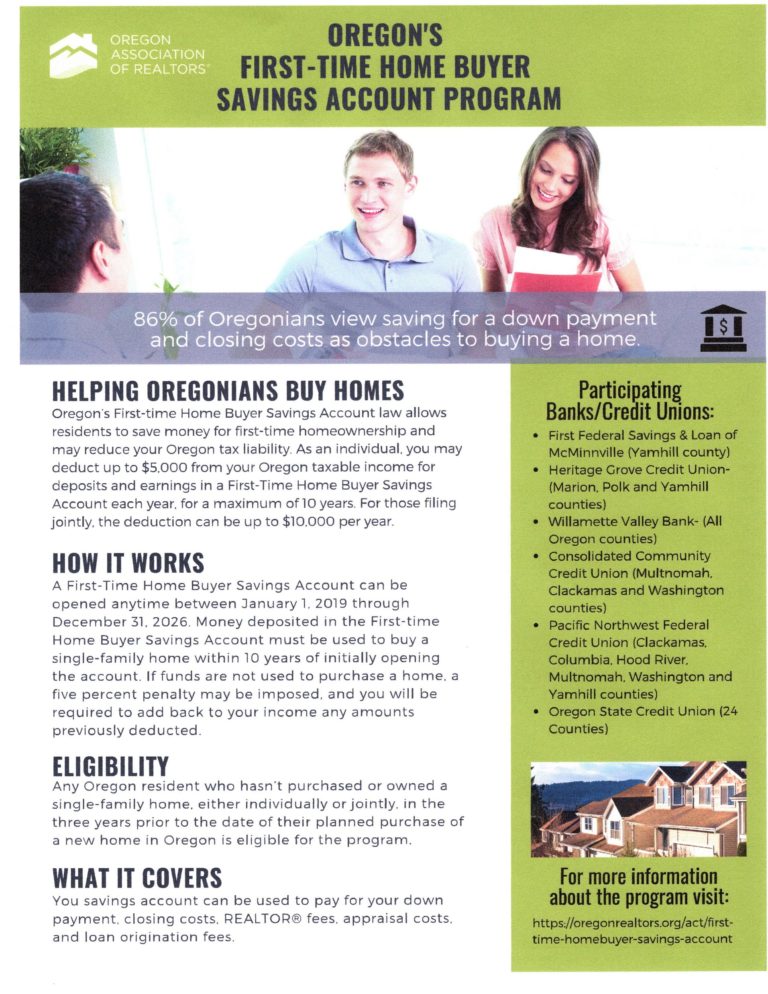

They assume the HBTC only applies to those who've never owned a home. If you haven’t owned a home in the past 4 years, you may also qualify for the benefits. For agreements of purchase and sale entered into after December 13, 2007, an eligible home. For agreements of purchase and sale entered into after November 14, 2016 and registered on or after January 1, 2017, proof of Canadian citizenship or permanent residence in Canada.

The home also must be registered in your name or your partner’s name. Sign on with a different card number to CIBC online banking. Get your Ministry of Finance refund or rebate faster with direct deposit! Proof of occupancy, with the new address listed, such as copies of telephone/cable bills, credit card statements, driver's licence, newspaper/magazine subscriptions, etc.

First-Time Home Buyer Programs and Rebates in Canada

Luckily, you can obtain some financial aid during tax season to help pay for some of these extra costs using the First-Time Home Buyers’ Tax Credit. For agreements of purchase and sale entered into before December 14, 2007, a copy of the Tarion New Home Warranty, which is also known as the Certificate of Completion and Possession. A copy of the agreement of purchase and sale, together with all schedules, amendments and assignments, along with a copy of the statement of adjustments relating to the conveyance. The purchaser cannot have ever owned aneligible home, or an interest in an eligible home, anywhere in the world, at any time. A mortgage specialist can help you see what you can afford, as well as which programs might be able to help you at a local, provincial, and federal level.

In three provinces and one city, first-time homebuyers can additionally claim a land transfer tax rebate. Land transfer taxes are charged by all provinces excluding Saskatchewan and Alberta. An additional land transfer tax is charged by the city of Toronto. In Ontario, British Columbia, Prince Edward Island, and the city of Toronto, first-time homebuyers are eligible for a rebate of these land transfer taxes, subject to certain maximums and conditions. When more than one person is entitled to the HBTC , the total of all amounts claimed cannot be more than $5,000.

First-time homebuyer programs and benefits

For example, if you are in a 40% tax bracket and plan to save $10,000 towards your future down payment every year, that $10,000 is equivalent to approximately $16,667 of before-tax income. With an RRSP, you would be able to contribute the full before-tax income amount to your future down payment, allowing you to save 66% more from each paycheck compared to saving in a typical after-tax account. Marissa makes $80,000 a year, and has $60,000 saved up for a down payment.. To qualify for the shared-equity incentive, she can purchase a home worth up to $380,000.

The purchased home must be in Canada and registered with the appropriate land registry office — in your name, or in your and your spouse's or common-law partner's names. The First-Time Home Buyer’s Tax Credit allows first time buyers in Canada a small refund on a portion of their tax return. While it is not a huge amount of money, it’s available to most first time buyers and is a relatively straightforward tax credit to get, so it’s worth looking into. In this article, we’ve outlined what the HBTC is, how much it is, and other first time home buyer incentive programs in Canada. The Home Buyers’ tax credit, also known as the Home Buyers’ amount, is a federal government program to make homeownership more attainable for some Canadians. The program allows eligible first-time home buyers to claim a $5,000 non-refundable income tax credit.

Your Land Transfer Tax Breakdown

Jessica followed up quickly and was extremely patient, helpful and quick to respond to all my questions. Help protect yourself and your family from regular health and dental costs. Secure yourself with affordable life insurance from Canada’s top providers and be protected in minutes.

He has written articles about personal finance, mortgages, and real estate and is passionate about educating people on how to make smart financial decisions. Mark graduated from the Northern Alberta Institute of Technology with a degree in finance and has more than ten years' experience as an accountant. Outside of writing, he enjoys playing poker, going to the gym, composing music, and learning about digital marketing.

The GST/HST New Housing Rebate is run by the federal government with a provincial component, but it’s the same across the country. If the refund is claimed at the time of registration, it may offset the land transfer tax that would be payable. If the refund is not claimed at registration, the tax must be paid, and a claim for the refund may be submitted to the Ministry of Finance. Procedures for refunds are outlined below, underProcedures to apply for the refund. This home can be for yourself or a related person with a disability, and you must meet the government’s criteria to qualify.If you’re eligible, you can borrow up to to $35,000 interest-free from your RRSP. This is per person, so if you’re buying with a partner, you could be eligible to use $70,000 as a couple to finance your home.

The CMHC mortgage insurance premium does not count towards the limit. After the data from the chart below was released, the CMHC expanded the program in May 2021 to increase its popularity in the Toronto, Victoria, and Vancouver CMAs. Previously, the maximum qualifying home purchase price was $505,000. Given the high average household prices in these regions, the program was expanded to a maximum home purchase price of $722,000. In most provinces, when you buy a home or property, you may have to pay a land transfer tax to the provincial government at the time of closing. Some cities including Toronto also charge a separate land transfer tax.

This means you did not live in another home owned by you or your spouse/common-law partner in the year of the acquisition of this home, or in any of the four preceding years. The information provided is based on current laws, regulations and other rules applicable to Canadian residents. It is accurate to the best of our knowledge as of the date of publication. Rules and their interpretation may change, affecting the accuracy of the information.

First-time homebuyers of an eligible home may be eligible for a refund of all or part of the tax. However, you may get some or all of this money back, as to help first-time buyers offset this cost, most provinces offer a partial or full tax rebate. The amount of tax you’ll pay is a percentage that is calculated depending on how much you paid for your home, which can amount to several thousands of dollars in closing costs. Land transfer tax is an upfront payment that can’t be factored into your mortgage, so it’s important to consider how this lump sum will impact the final cost of your property. It’s worth noting that this rebate is open to all homebuyers, not just those buying for the first time.

One of the most intense challenges for first-time homebuyers is stepping into the market when the housing supply has largely dried up. There are cases where a lender may need a bigger down payment in order to approve you for a mortgage. You must intend to occupy the home, or you must intend that the related person with a disability occupy the home, as a principal place of residence no later than one year after it is acquired. The purchase must be made to allow the person with the disability to live in a home that is more accessible or better suited to their needs.

Mortgage default insurance or CMHC Insurance, might seem like an odd concept, but it’s actually pretty straightforward. If you have a down payment of less than 20% of the home’s value, you have to purchase mortgage default insurance. Actually, it protects your lender in case you can’t make your mortgage payments. It’s built to make financial institutions okay with lending to individuals who don’t have a sizable down payment. The federal government announced in 2022 the creation of a new program to help new buyers save for their first house. The First Home Savings Account, or FHSA, blends features of the Tax-Free Savings Account and Registered Retirement Savings Plan , with some advantages over both.

Land transfer tax applies to all conveyances of land in Ontario. First‑time homebuyers may be eligible for a refund of all or part of the tax payable. In most provinces and cities, you’ll need to payland transfer taxOpens in a new window - Opens in a new windowwhen you buy a property. Provided you haven’t lived in another home that you’ve owned for any of the 4 years prior to purchase, you could be eligible if you and your partner bought a home that meets the government’s criteria. If you have purchased a newly constructed or substantially renovated home, you may be eligible to reclaim the GST or federal part of the HST charged on the purchase of said property. Jessica and her husband each withdraw $35,000 from their own RRSP account.

No interest is charged in either case and both gains and losses are shared proportionally with the government. Since its inception, the CMHC First-Time Home Buyer Incentive has benefited 10,952 home buyers. The program was designed to contribute $1.25 billion to 100,000 Canadians over a three-year period. However, to date, the program has only funded $216.5 million in shared equity mortgages. As of March 2021, the program is most successful in Quebec and Alberta, where there have been around 3,800 and 2,800 respectively. The program is least popular in Victoria, Vancouver, and Toronto housing markets with only 5, 9, and 39 successful applicants.